Description

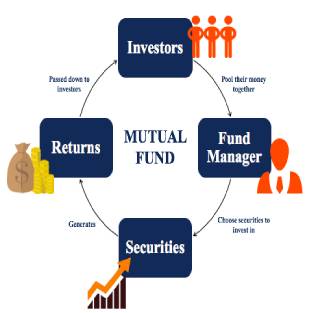

A mutual fund is a kind of investment that uses money from investors to invest in stocks, bonds or other types of investment. A fund manager (or “portfolio manager”) decides how to invest the money, and for this he is paid a fee, which comes from the money in the fund.

A mutual fund is an investment vehicle that pools money from investors with a common investment objective. It then invests the money in various asset classes like equities and bonds based on the scheme’s objectives. An asset management company (AMC) makes these investments on behalf of the investors.

Some examples are: Growth funds focus on stocks that may not pay a regular dividend but have potential for above-average financial gains. Income funds invest in stocks that pay regular dividends. Index funds track a particular market index such as the Standard & Poor’s 500 Index.

- Equity or growth schemes. These are one of the most popular mutual fund schemes. …

- Money market funds or liquid funds: …

- Fixed income or debt mutual funds: …

- Balanced funds: …

- Hybrid / Monthly Income Plans (MIP): …

- Gilt funds:

Reviews

There are no reviews yet.