Understanding NBFCs: A beginner’s guide to Non-Banking Financial Companies

The present banking system of India is not able to fulfill all the financial requirements of the economy. This is where the role of the Non-Banking Financial Companies comes into the picture.

Non Banking Financial Companies are institutions growing at a fast-pace since the last decade and are very powerful in bridging the gaps between the traditional banks and the customers. It plays a very crucial role in India’s financial ecosystem and caters successfully to the varying needs of the businesses and individuals.

In this article, we’ll talk about Non-Banking Financial Companies (NBFCs), it’s functions, how they differ from banks, and the importance of Virtual CFOs in NBFCs.

What is an NBFC?

Non Bank Financial Companies or NBFC is also known as Non Bank Financial Institutions is a company registered under the Companies Act,1956. It provides all the banking services from loans, acquisitions, financing to currency exchanges and retirement planning, but it functions without any license issued by the government. It basically works to bridge the gap between the traditional banks and customers by offering a vast range of financial products and services.

As per the 1934 act of RBI, the Reserve Bank of India holds the authority to control and regulate the Non Banking Financial Companies. Non Banking Financial Companies have drastically increased in number in the recent times, especially after the Great Recession and is constantly helping in catering to all the unmet credit demands in the market.

It functions as a very important part of the financial ecosystem in India. Various examples of Non Banking Financial Companies in India includes Piramal Capital, Mahindra and Mahindra Financial Services, TATA Capital Financial Services, PNB Housing Finance,etc.

Functions of Non Banking Financial Companies:

The Non-Banking Financial companies perform several functions like:

- Financing Assets: Non Banking Financial Companies provide fund for the leasing or purchase of assets like real estate, vehicles, equipments,

or machinery. - Discounting of Invoice and Factoring: By providing the invoice discounting and Factoring services enabling the business to fullfill their working capital requirements and providing liquidity to the the business.

- Credits, Lending and Microfinance: The Non Banking Financial Companies provide flexible credit facilities and lending solutions for both personal and

businesses. NBFCs also specialize in providing financial services and loans to the small and medium enterprises (SMEs),self help groups,low income families,etc. - Investment, Advisory, and Foreign Exchange Services: Services including portfolio management, investment advisory and risk management are provided to the clients. Various foreign exchange services which helps in currency exchange and remittance transactions are provided by the NBFC.

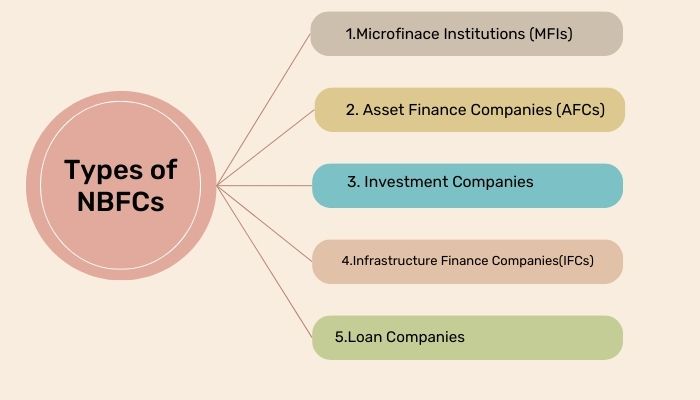

Types of NBFCs in India

The various types of Non Banking Financial Companies in India includes:

1.Microfinace Institutions (MFIs)

It basically targets the economically wekaer sections of the society by providing them various small or micro loans, helping them to expand their small businesses and fosters financial inclusion and financial inclusion.

2. Asset Finance Companies (AFCs)

It is mainly involved in providing financing assets through loans and leases to the Small and Medium-sized enterprises (SMEs) for various tangible assets and offers personalised financing solutions for acquiring assets.

3. Investment Companies

Non Banking Financial Companies help the retail and institutional investors in the management and acquisitions of bonds, stocks, mutual funds and other financial assets.

They also help in increasing the opportunities of investing opportunities and encouraging the practices of investment.

Holding more than 90 percent of its assets in the form of investment in the financial assets in its group companies, debts or equity shares, CICs-SI or Systematic important core investment companies is another important subset of investment companies,playing an integral role in the

financial inclusion process.

4.Infrastructure Finance Companies(IFCs)

This plays an important role in supporting the development of nations infrastructure by funding multiple projects in this domain.

They provide project-specific,long term funding and strengthen the economic progress and overall development of the nation.

5.Loan Companies

They help in bridging the gap between traditional banks and the customers by providing them with personal loans, home loans, education loans and working capitals through project and trade finance.

Differences between NBFC and Banks:

● Both NBFC and Banks provide banking services but for a bank to operate in India, it should have the license but an NBFC can operate without a banking license.

● An Non Banking Financial Companies cannot accept demand deposit from the people and are not covered in the Payment and Settlement Act,2007 (PSS Act) of India.

● Non Banking Financial Companies mostly engagement in lending and investment activities while a traditional bank offers a wide range of banking services.

● A bank can accept and issue cheques while an NBFC cannot.

● A bank can create credit cards through fractional reserve banking while an Non Banking Financial Companies cannot create credit like banks.

● Government insurance schemes may guarantee deposits in the banks and can access payment systems and borrow money from the RBI but no such preferences are provided for the Non Banking Financial Companies.

● The banks are mandated to provide a percentage of their lending to the priority sectors while an Non Banking Financial Companies is not required to follow such regulations.

Problems faced by NBFCs

There are a number of issues faced by the NBFCs.Some of them are mentioned below:

● The number and types of regulatory compliances to be filed for NBFC and the process to follow for the same is difficult to understand and follow.

● The process of getting a license and completing all the documentation is complicated.

● Various small NBFCs struggle to find capital and funding for their institutions.

● Non Banking Financial Companies also face challenges in accessing their market data analytics and liquidity management.

● They also face unfair tax treatment and do not get access of defaulter database

Virtual CFO for NBFCs:

Some of the problems faced by Non Banking Financial Companies today can be easily solved by hiring a Chief Financial Officer for your organization.

With the increase in digitization, the demand for Virtual CFOs for Non Banking Financial Companies is rising exponentially. While providing all the services offered by the traditional CFOs, the Virtual CFOs are more flexible and can be hired as per its specific needs and requirements.

The top Virtual CFOs for NBFCs can be hired from anywhere around the world and at any stage, as per the requirement. They can also be hired on a weekly or project basis to manage the finances of the company.

From managing compliance, operational, IT and financial risks to managing accounting, cash flow while creating growth expansion and growth strategy, a Virtual CFO plays an integral role in the Non Banking Financial Companies or NBFCs.

Conclusion

NBFCs or Non Banking Financial Companies are an integral part of India’s financial ecosystem. It provides a range of financial tailored services and complements the traditional banking system of India.

It helps in various sectors from loans and credits to infrastructure and development, thus contributing to the overall economic progress of the country. With the vast range of functions offered by the NBFCs as discussed above,a need for CFO to manage and overlook the finances

becomes integral.

Hiring a Virtual CFO for NBFCs is one of the best options to consider for your institution.

Transforming Finance: The Synergy of NBFCs and Fintech in Digital Lending

The finance world is undergoing a serious makeover, thanks to the digital wave crashing through every aspect of our lives.

One of the most fascinating transformations is how Non-Banking Financial Companies (NBFCs) are teaming up with the Fintech startups. This collaboration is about leveraging technology to ease traditional processes and also about redefining the way financial services are offered, making them more accessible, inclusive, and efficient than ever before.

NBFCs bring to the table their vast experience in understanding diverse consumer financial needs and providing tailored financial products. On the other hand, Fintech companies inject innovative technology and digital savviness into the equation. Together, they are not just filling gaps left by traditional banks but are creating a new ecosystem that fosters financial inclusion and delivers personalized financial solutions at the speed of need.

The synergy between NBFCs and Fintech companies is more than a mere partnership. It’s a powerful collaboration that is reshaping the digital lending. Through their innovative approaches, these partnerships are opening new avenues for consumers to access financial services, simplifying processes, and ensuring a smoother user experience. Whether it’s providing loans to underserved segments or offering flexible repayment options, the impact of these collaborations is profound and far-reaching.

As we get into the dynamics of these collaborations, it’s important to understand how they are beneficial for consumers and also for the economy. By leveraging each other’s strengths, NBFCs and Fintech companies are setting new benchmarks in the financial sector, establishing a model for others to follow. Let’s explore more and learn what the future holds for this promising alliance.

The Rise of NBFC-Fintech Collaborations in Digital Lending

The financial landscape is undergoing a rapid transformation, largely due to the synergistic partnerships between NBFCs and Fintech companies. This evolving dynamic is setting the stage for a revolution in digital lending, impacting how loans are processed, disbursed, and managed.

So, what’s this NBFCs teaming up with Fintech startups beneficial?

Yes, because it’s all about using tech to make financial services easier and available to more people.

The rise of NBFC-Fintech collaborations is a reflection of the industry’s commitment to leveraging technology to streamline financial services and widen their reach.

• Understanding NBFCs

Did you know how important Non-Banking Financial Companies (NBFCs) are in the financial world?

They serve as vital channels for extending credit to parts of the economy that banks usually overlook. It’s like they’re bridging the gap, right? Now let’s understand this in depth.

Unlike banks, NBFCs do not hold a banking license but operate under the regulation of the central bank, offering loans, credit facilities, and other financial services. Their agility, simpler procedures, and focus on unserved and underserved markets make them vital to financial inclusion.

However, their scope and capacity are often limited by the lack of advanced technology and broader customer reach, constraining their ability to serve a larger clientele.

Exploring Fintech Companies

Fintech, a blend of “financial technology,” refers to the innovative use of technology in delivering financial services. From mobile banking and insurance to crowdfunding and blockchain-based transactions, Fintech companies are at the forefront of the digital revolution in finance.

Fintech companies are like the tech-savvy solutions of the financial world! They’re really good at handling lots of data super quickly, which helps them make fast decisions and offer personalized financial solutions. And when it comes to transactions, they’re all about being fast and making sure everything is safe and secure.

But, you know, it’s not always easy for them. They sometimes run into problems with rules and FSDC regulations, and they might not have as much money or as many customers as the big traditional banks. So, they’ve got to work extra hard to find their place in the financial world.

Benefits of NBFC-Fintech Partnerships

The collaboration between NBFCs and Fintech companies is meeting of finance and technology.

You get the best of both world when NBFCs and Fintech companies team up- finance and technology together to create a smooth digital lending. They are ready to fill each other’s gap and crank up their strengths to a whole new level. And the perks? With this partnership, they can streamline processes, offer more personalized services, and reach out to a wider audience.

NBFCs Gain:

- Wider Reach:

NBFCs, with their established networks and infrastructure, often possess extensive reach, particularly in areas where traditional banking services may be limited. By partnering with Fintech firms, they can leverage digital platforms to extend their services even further, tapping into previously underserved markets and segments.

- Faster Loan Processing:

The integration of Fintech solutions enables NBFCs to streamline their loan processing workflows. Through automation, data analytics, and AI-driven algorithms, cumbersome manual processes can be replaced with efficient and accurate systems, reducing turnaround times and enhancing customer satisfaction.

- Improved Risk Management:

Risk assessment is a cornerstone of NBFC operations. Fintech tools offer advanced analytics and predictive models that augment traditional risk management frameworks. By harnessing real-time data and sophisticated algorithms, NBFCs can make more informed lending decisions, mitigating risks and improving portfolio quality.

- New Product Offerings:

Collaborating with Fintechs injects fresh perspectives and innovative solutions into NBFC product development. Whether it’s microloans for small businesses, personalized lending products, or novel investment vehicles, this partnership fosters creativity and diversification, catering to evolving consumer needs and preferences.

Fintech’s Gain:

- Access to Capital:

For many Fintech startups, securing adequate funding is a significant challenge. Partnering with established NBFCs provides access to capital, allowing Fintech firms to fuel their growth initiatives, scale operations, and expand market presence. This infusion of funds accelerates innovation and fosters entrepreneurship within the Fintech sector.

- Regulatory Compliance:

Navigating regulatory frameworks can be daunting for Fintech companies, especially as they strive to maintain compliance while rapidly evolving their offerings. Teaming up with NBFCs, which possess regulatory expertise and established compliance frameworks, provides Fintech firms with invaluable guidance and support, ensuring adherence to industry standards and regulations.

Credibility and Brand Recognition:

Established NBFCs bring credibility and trust to the table. By associating with reputable financial institutions, Fintech startups enhance their brand image and gain validation in the eyes of consumers and investors alike. This partnership opens doors to new business opportunities and strengthens the Fintech firm’s position within the market.

In essence, the collaboration between NBFCs and Fintechs heralds a new era of financial innovation and inclusivity. By pooling their resources, expertise, and capabilities, these entities can overcome existing challenges, capitalize on emerging opportunities, and ultimately deliver greater value to customers.

The partnership between NBFCs and Fintech companies has paved the way for a revolutionary borrowing experience, for Small and Medium Enterprises (SMEs).

Key Challenges and Solutions in Collaborations

When Non-Banking Financial Companies (NBFCs) and fintech enterprises team up to revolutionize digital lending, they face hurdles just like on a challenging journey. It’s crucial to spot these hurdles early and come up with smart solutions to overcome them. Using facts and asking the right questions can help them make the most of their partnership.

· Regulatory Hurdles

One of the most significant obstacles NBFC-fintech collaborations face is the complex web of regulations governing the financial sector.

Regulatory challenges stem from differences in oversight for NBFCs and fintech firms, leading to confusion and potential non-compliance risks. A solution to this challenge lies in adopting a proactive approach to regulatory compliance. Collaborating firms can appoint dedicated teams to monitor regulatory changes and ensure that their products and services comply with the latest financial laws and guidelines.

Working closely with regulators to understand expectations and even pushing for modernized regulations that reflect the digital age can also pave the way for smoother operations.

· Technology Integration

Combining the technological prowess of fintech companies with the robust financial infrastructure of NBFCs can be a game-changer. However, it also presents a substantial challenge — technology integration. The disparity between the digital maturity of fintechs and the potentially outdated systems of NBFCs can hinder seamless cooperation. To overcome this, both parties should prioritize investing in compatible technologies and flexible platforms that facilitate integration. Adopting APIs (Application Programming Interfaces) to connect different software and systems or embracing cloud computing are effective ways to ensure that technological integration supports, rather than hampers, the collaboration’s goals.

· Data Security Concerns

Now the question is “Why is data security important in fintech-NBFC collaborations?”

Well, the answer is data is backbone of each sectors and businesses.

When fintech and NBFCs join forces and merge customer data, they become vulnerable to breaches, which can result in financial loss and harm to their reputation.

The next step come is what are the steps taken to address data security concerns in these collaborations?

To address data security concerns, stringent cybersecurity measures should be implemented. These include advanced encryption techniques, regular security audits, and providing training to employees on data protection protocols. Additionally, fostering a culture of cybersecurity awareness and ensuring compliance with international data protection standards are essential steps in safeguarding sensitive information against cyber threats.

Closer Look at FSDC’s Guidelines

The Financial Stability and Development Council (FSDC) in India has introduced crucial guidelines for digital lending. This aims to foster a safe and efficient ecosystem for borrowers and lenders alike.

- FSDC guidelines for digital lending emphasize the arrangement of Fair, Transparent, and Non-Discriminatory (FTND) practices.

- FTND practices ensure fairness, clarity, and absence of bias in digital lending operations.

- Digital lenders commit to providing clear terms and conditions, transparent interest rates, and non-discriminatory practices.

- FTND principles enhance consumer protection and foster trust in the digital lending ecosystem.

- These guidelines promote financial inclusion and contribute to sustainable economic growth.

The Future of Collaborations: Trends and Innovations

As NBFCs and fintech firms work together to overcome challenges, what exciting developments can we expect in this future of digital lending? let’s learn:

· AI and Machine Learning Role

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of shaping the future of digital lending. These technologies enable more accurate and efficient risk assessment, personalized lending experiences, and innovative loan management solutions. By leveraging AI and ML, collaborations can offer instant loan approvals based on predictive analytics, dynamically adjust interest rates based on real-time data, and enhance customer service through chatbots and automated advisory services. The potential to streamline operations, reduce costs, and deliver superior customer experiences makes AI and ML pivotal in the evolution of digital lending.

· Blockchain Technology in Financial Inclusion

Blockchain technology, with its decentralized and transparent nature, has the potential to revolutionize financial inclusion efforts led by NBFC-fintech collaborations. By creating tamper-proof records of transactions, blockchain can increase trust in digital financial services among underserved populations. It can also reduce transaction costs and improve the efficiency of remittances, making financial services more accessible to those in remote or marginalized communities. Furthermore, blockchain-based identity verification systems can offer a secure and reliable means of establishing creditworthiness for individuals lacking traditional financial histories, opening doors to a whole new demographic of borrowers.

As NBFCs and fintech firms continue to navigate their partnership journey, overcoming key challenges and embracing future trends and innovations. They’re paving the way for a more inclusive, efficient, and secure digital lending ecosystem that promises to benefit all stakeholders in the long run.

Conclusion: The Path Ahead for NBFC-Fintech Collaborations in Digital Lending

In the bustling world of finance, the partnership between Non-Banking Financial Companies (NBFCs) and Fintech firms is a beacon of progress. It illuminates the path forward in the era of digital lending. The journey so far has been promising, with fintech innovations turbocharging the capabilities of NBFCs, making loans more accessible, and simplifying the borrowing process for consumers.

Looking ahead, we can expect these collaborations to delve deeper into using cutting-edge technologies like artificial intelligence, blockchain, and machine learning. These tools will help in delivering more personalized, efficient, and secure lending services. We might also see a greater focus on financial inclusion.

- Innovation and Customer Experience: Emphasizing continuous innovation to improve financial products and services.

- Regulatory Compliance and Trust Building: Ensuring that collaborations adhere strictly to regulatory requirements, fostering trust among consumers.

- Sustainability and Inclusion: Focusing on sustainable lending practices that promote financial inclusion, providing opportunities for those in less privileged circumstances to access financial services.

Introduction to RBI’s Draft Guidelines for Transparent Digital Loans

The RBI has issued guidelines to regulate digital loan aggregators, now termed Lending Service Providers (LSPs). These rules aim to organize and oversee the digital lending sector, ensuring transparency and protecting borrowers from malpractices.

Complete Guide on How to File a Patent for Your New Invention in India

The RBI has issued guidelines to regulate digital loan aggregators, now termed Lending Service Providers (LSPs). These rules aim to organize and oversee the digital lending sector, ensuring transparency and protecting borrowers from malpractices.

How to Leverage Telco Based Data for Credit Scoring

Explore the critical role of telco data in credit scoring. Discover actionable strategies to optimize financial assessments positively with telecom-based insights.

Virtual CFO Services: Your Key to Enhancing the Financial Decision Making At Your Company

Discover the advantages of virtual CFO services for small businesses. Optimize finances, drive growth, and ensure stability with expert guidance.

Virtual CFO Vs Traditional CFO: Which is better for your business?

Explore the pros and cons of virtual CFO and traditional CFO services to determine the best fit for optimizing financial management in your business.

RBI Keeping a Close Eye on NBFCs’ Direct Selling Agents (DSAs) Outsourcing

Discover how RBI monitors NBFCs’ Direct Selling Agents (DSAs) to ensure compliance and minimize risks. Stay informed on regulatory scrutiny.

Establishing a Finance Company in GIFT City: A Comprehensive Guide

RBI, on October 22, 2021, mandated Non-Banking Financial Companies (NBFCs) with 10 or more branches to adopt CFSS

India’s Fintech Revolution: Unveiling a $400 Billion Value Potential by 2030

xplore the future implications of the Fintech Revolution in India, examining anticipated developments within the FinTech Market for the year 2030.

Navigating the Financial Landscape: Understanding TPAPs in India’s UPI Ecosystem

Explore how Third-Party Application Providers (TPAPs) shape and innovate within India’s UPI Ecosystem, facilitating seamless digital transactions for users and businesses alike.

Revolutionizing NBFC Automation Solutions in India

Empower your NBFC automation solutions in India. Enhance efficiency, drive performance, and ensure sustainable growth with tailored automation strategies.

NBFCs’ Financial Evolution with Core Financial Service Solution(CFSS)

Explore how NBFCs leverage CFSS for financial evolution. Streamline operations and drive growth efficiently. Learn more!

The Growing Trend of AIFs in India

(AIF) is a different way to invest. Instead of the regular stuff like stocks, it tries out special things like venture capital, private equity, hedge funds.

Understanding RBI’s New Guidelines on Penal Charges on Loans

February 2, 2024

The Reserve Bank of India (RBI) recently issued guidelines on penal charges for loans, marking a significant shift in lending practices across the country. Effective from August 18, 2023, these guidelines apply to major banks, smaller cooperatives, and Non-Banking Financial Companies (NBFCs).

The aim is to promote responsible lending and transparency. By simplifying borrowing processes, borrowers gain clarity on loan terms, fostering trust and confidence in the lending ecosystem. Essentially, it sets the stage for a lending environment where people are well-informed and confident about their financial commitments.

Key aspects of the new guidelines:

Penal Charges vs. Penal Interest: It’s crucial to distinguish between penal charges and penal interest, as penal charges are distinct from the loan’s interest rate and cannot be imposed as “penal interest.”

Reasonableness and Proportionality: Charges should be reasonable and proportionate to the severity of non-compliance, avoiding blanket charges that lack fairness.

Non-Discriminatory Application: Charges must be applied uniformly within the same loan or product category, ensuring fairness across individual and non-individual borrowers.

Transparency and Clarity: Lenders must have a Board-approved policy outlining their penal charges structure, clearly communicating it to borrowers to ensure transparency.

No Compounding: Compounding of penal charges, including interest on interest, is prohibited to safeguard borrowers’ financial interests.

Implementation Timeline: The guidelines apply to new loans from April 1, 2024, and to existing loans by June 30, 2024, at the next review or renewal date, providing a clear timeline for compliance.

Applicability of the new RBI guidelines on penal charges for loans

The applicability of the new RBI guidelines on penal charges for loans depends on two factors: the type of loan and the loan’s timeline.

These guidelines are applicable to a wide array of loan categories, including home loans, personal loans, car loans, educational loans, credit card loans, and overdraft facilities. They are designed to ensure consistency and fairness in the application of penal charges across these retail lending segments. However, trade credit, structured obligations, and wholesale loans to businesses are excluded from these regulations. This ensures clarity and specificity in the application of penalties while maintaining appropriate regulatory oversight.

The RBI’s new guidelines on penal charges apply to loans sanctioned from April 1, 2024, onwards. For existing loans sanctioned before this date, compliance begins either at the next review/renewal date or within six months from August 18, 2023, with a deadline extension to June 30, 2024. This phased approach ensures a smooth transition while maintaining fairness in lending practices.

Securitisation and Co-lending Portfolios

The RBI rules are vital for charges in securitization and co-lending. In securitization, focus on clarity of loans, ensuring transparency throughout the process. Co-lending shared responsibility, so fair practices matter in all transactions.

Applicability of GST

Due to the lack of clear guidelines, the GST applicability on penal charges remains uncertain. RBI aligns with GST exemption for loan interest, but recent changes create confusion.

Application of Circular on Bank Guarantee/ Letter of Credit Invocation

RBI’s Circular on BG/LC Invocation means banks must stick to guarantee terms, promptly paying when beneficiaries ask. It keeps things fair and stable. Resolve issues peacefully, saving legal action as a last resort for smooth banking.

Applicability to Cash Credit and Overdraft Facilities:

RBI’s guidelines cover all retail loans, including Credit Card (CC) and Overdraft (OD) facilities, except for trade credit and structured obligations.

Applicability of Guidelines in Case of Default:

The RBI’s new guidelines on penal charges do not directly address loan defaults. They primarily focus on non-compliance situations like exceeding withdrawal limits, missed minimum balance requirements, and late payments.

However, lenders have the flexibility to define separate policies for charges in case of default within their overall credit risk management framework

Compliance and action points for lenders

The circular mandates regulated entities to:

- Create board-approved policies on penal charges, including default scenarios and charge determination principles.

- Disclose penal charges and reasons in loan agreements.

- Display key terms on penal charges on their website.

- Communicate applicable penal charges to borrowers during reminders for non-compliance, including reasons for their imposition.

Impact and Future Direction

The Circular takes effect on January 01, 2024. For new loans, compliance is immediate. Existing loans must implement penal charges during the next review, renewal, or within 6 months from the Circular’s effective date, ensuring adherence to its terms. It aims to make penal charges fairer, transparent, and non-discriminatory, enhancing access to credit and addressing customer grievances.

FAQs

For existing loans, the transition to the new penal charges regime happens on the next review or renewal date occurring on or after April 1, 2024, or within six months from the circular’s effective date, whichever is earlier.

Are penal charges applicable to trade credit and structured obligations?

What terms and conditions are considered important for applying penal charges?

What happens to penal charges in NPA accounts?

Can penal charges vary within the same loan category based on the loan amount?

Is GST applicable on penal charges, and when is it payable?

Slowdown in NBFC Licensing and the Fintech Challenges in India

Slowdown in NBFC Licensing and the Fintech Challenges in India

February 1, 2024

Curious about the slowdown in NBFC licensing and the challenges Fintech faces in India? Explore our blog to uncover insights on navigating the hurdles of NBFC licensing and addressing Fintech challenges effectively.

Fintech companies in India, known for their fast and affordable financial services, are facing a challenge. The process of getting licensed as a Non-Banking Financial Company (NBFC), a key step for these tech-driven firms to provide various financial services, has significantly slowed down. This slowdown is causing problems for Fintech companies and impacting their plans for growth.

The issuance of NBFC licenses in India has slowed significantly in past few years. This decline reflects Fintech companies, which use technology for finance services, are having a harder time reaching more people and changing how financial services work. The delay in licensing, especially for Fintech companies aiming to become NBFCs, is now a major topic of conversation.

Reasons Behind the NBFC Licensing Slowdown

RBI’s Cautious Approach:

Market Stagnation: With economic growth slowing down, the Reserve Bank of India (RBI) has adopted a cautious stance towards issuing new NBFC licenses. They worry about oversaturation in a stagnant market, where existing NBFCs might struggle to compete, increasing financial instability.

Post-Crisis Concerns: Recent crises like the IL&FS and DHFL debacles have rattled the NBFC sector and raised concerns about its systemic stability. The RBI, responsible for maintaining financial stability, is understandably less eager to grant new licenses in this climate.

Unregulated Chinese Players: The influx of unregulated Chinese players in the lending space has further stoked the RBI’s apprehension. The lack of proper oversight raises concerns about predatory lending practices and financial risks, leading to stricter scrutiny for all new entrants, including Fintech companies.

The issuance of NBFC licenses in India has slowed significantly in past few years. This decline reflects Fintech companies, which use technology for finance services, are having a harder time reaching more people and changing how financial services work. The delay in licensing, especially for Fintech companies aiming to become NBFCs, is now a major topic of conversation.

Stringent Regulatory Environment:

Increased Scrutiny: The RBI has tightened the licensing process, demanding higher minimum capital requirements, stricter due diligence, and enhanced governance standards. This rigorous vetting, while meant to ensure financial stability, also creates a significant hurdle for new players, especially young Fintech startups.

Complex Guidelines: The regulatory framework surrounding NBFCs is intricate and evolving, often leaving applicants navigating a murky terrain with unclear expectations. This complexity discourages potential entrants and delays the approval process.

Challenges Faced by Fintech Players due to NBFC Licensing Slowdown

Restricted Entry and Growth

The restricted entry and growth present a considerable barrier. The sluggish issuance of NBFC licenses directly hampers Fintech’s operations in crucial areas such as lending, payments, and wealth management. Without access to NBFC licensing, expansion becomes challenging, limiting Fintech companies to specific business models and impeding their growth potential.

Increased Competition and Market Barriers

The complexities of licensing and regulatory compliance make it difficult for Fintech companies to form partnerships and collaborations with traditional financial institutions, limiting their access to resources and customer base.

Financial and Resource Constraints

The costs associated with regulatory compliance can be prohibitively expensive for startups, impacting their financial resources and competitive capabilities. The slowdown in the sector may also erode investor confidence in Fintech, making it harder for companies to raise capital and sustain operations.

Recommendations for Fintech Players

Explore Mergers and Acquisitions:

Fintech companies struggling to get NBFC licenses could consider teaming up with existing NBFCs through mergers or acquisitions. This collaboration offers a smoother regulatory process and access to an established customer base.

Partnering with Established NBFCs:

By teaming up with established NBFCs, Fintech companies can strategically enter the lending space. This collaboration allows them to benefit from the infrastructure and regulatory approvals of well-established players, creating win-win partnerships.

Exploring Acquisitions of Existing NBFCs:

Another viable option is acquiring or taking over existing NBFCs, especially those facing challenges. This approach offers a quicker market entry, utilizing the pre-existing regulatory approvals and infrastructure. It also provides the flexibility to restructure and rebrand as needed.

The NBFC licensing slowdown poses challenges to India’s Fintech revolution, but it’s also an opportunity for Fintech players to showcase resilience. Fintech players need to adjust their strategies to navigate the changing regulatory landscape. Exploring collaborations, mergers, and acquisitions with existing NBFCs emerges as viable alternatives. In the dynamic financial environment, strategic partnerships could be the essential element for Fintechs to effectively enter the NBFC space in India.

Navigating the Regulatory Landscape: A Comprehensive Guide to NBFC Takeovers

Navigating the Regulatory Landscape: A Comprehensive Guide to NBFC Takeovers

October 23, 2023

Looking to navigate the regulatory landscape of NBFC takeovers? Dive into our comprehensive guide for insights on seamless NBFC takeover processes.

Non-Banking Financial Companies (NBFCs) play a pivotal role in India’s financial ecosystem, providing diverse financial services and catering to various segments of the population. The Reserve Bank of India (RBI) has established stringent regulations to ensure the stability and integrity of the NBFC sector. The Non-Banking Financial Companies (Approval of Acquisition or Transfer of Control) Directions, 2014, issued by the RBI, outlines the crucial framework for the acquisition or transfer of control of NBFCs. In this comprehensive guide, we will delve into the intricacies of NBFC takeovers, exploring the reasons for such transactions, the step-by-step process, and the regulatory requirements that govern these transactions.

Reasons for NBFC Takeover

- Business Expansion: One of the primary motivations for an NBFC takeover is the desire to expand business operations. By acquiring another NBFC, companies can extend their reach and presence in new geographical areas, tapping into untapped markets and clientele.

- Access to New Markets and Customer Segments: Acquiring another NBFC can provide access to new markets and customer segments that may have been challenging to enter independently. This strategy allows companies to capitalize on existing customer bases and establish a broader market footprint.

- Diversification of Product Portfolio: A takeover can also help in diversifying the product portfolio or service offerings. This diversification strategy can reduce reliance on a single line of business and mitigate risks associated with market fluctuations.

- Economies of Scale and Efficiency: Merging with or taking over another NBFC can result in cost-saving opportunities and operational efficiency. Streamlining processes and consolidating resources can lead to economies of scale, ultimately enhancing profitability.

- Acquisition of Specialized Skills and Expertise: Companies may opt for a takeover to acquire specialized skills, technology, or expertise that are essential for their growth and competitiveness. This strategy allows them to gain a competitive edge in the market.

- Regulatory Compliance: In some cases, companies may undertake an NBFC takeover to ensure compliance with RBI regulations and guidelines. This can involve restructuring ownership or management to meet regulatory requirements.

The Process of NBFC Takeover

An NBFC takeover involves a series of steps to ensure a seamless transition and regulatory compliance:

1. Due Diligence:

The acquiring NBFC conducts due diligence to assess the financial, legal, and regulatory aspects of the target NBFC. This includes a thorough examination of the target’s books, operations, and compliance with regulations.

2. Regulatory Approvals:

The acquiring NBFC must obtain necessary regulatory approvals from the RBI and other relevant authorities. This includes seeking permission for the takeover, especially if it results in a change in management.

3. Acquisition Agreements:

The parties involved negotiate and enter into share purchase agreements or other acquisition agreements that outline the terms and conditions of the takeover.

4. Disclosure and Communication:

It is essential to make necessary disclosures to stock exchanges, shareholders, and other stakeholders to ensure transparency and compliance with regulations.

5. Transaction Completion:

Once all conditions are met, the transaction is completed, and control or management of the target NBFC is transferred to the acquiring company.

Regulatory Requirements for NBFC Takeover

The RBI has laid down specific regulatory requirements to govern NBFC takeovers:

- Minimum Net Owned Funds: The acquiring NBFC should have a minimum net owned fund of Rs. 2 crores, However, buyer should ready with Rs. 5 crores to meet the requirement of scale-based regulation issued by RBI.

- Positive Net Owned Funds: The target NBFC should have positive net owned funds; it should not have negative net owned funds.

- Management Continuity: The acquisition should not result in a change in the management of the target NBFC.

- Asset Classification and Provisioning Norms: The acquiring NBFC should maintain the asset classification and provisioning norms of the target NBFC.

- RBI Approval and Fit and Proper Criteria: The RBI should be informed about the proposed takeover, and necessary approvals should be obtained. The acquiring NBFC should meet the “fit and proper” criteria prescribed by the RBI.

- Shareholding Concentration: The acquiring NBFC should ensure that the shareholding of the target NBFC complies with the RBI’s guidelines on the concentration of shareholding and ownership in NBFCs.

- Capital Adequacy, Liquidity, and Risk Management: The acquiring NBFC should comply with the RBI’s guidelines on capital adequacy, liquidity, and risk management.

- Operational Viability: The acquiring NBFC should ensure that the financial and operational viability of the target NBFC is not compromised after the takeover.

Challenges in NBFC Takeover

NBFC takeovers are complex transactions that come with their own set of challenges:

- Valuation: Determining the fair value of the target NBFC and negotiating the acquisition price can be a challenging process.

- Integration: Integrating the operations, systems, and processes of two distinct entities can be a time-consuming and complex task.

- Retention of Key Employees and Customers: Maintaining employee and customer relationships post-acquisition is crucial. The loss of key employees or customers can impact the success of the takeover.

- Regulatory Compliance and Approvals: Meeting all regulatory requirements and obtaining necessary approvals from the RBI and other authorities can be a cumbersome process.

- Risk Management: Managing the risks associated with the acquisition and ensuring a smooth transition requires careful planning and execution.

NBFC Takeover Procedure

The NBFC takeover process involves several essential steps:

1. Memorandum of Understanding (MOU):

The first step is signing an MOU with the target company, outlining the responsibilities and requirements of each party. This agreement signifies mutual consent for the takeover.

2. Board Meeting:

Convene board meetings in both the acquiring and target companies to discuss the process, including fixing dates for extraordinary general meetings, passing resolutions, and addressing RBI queries.

3. Public Notice:

Publish a public notice in national and local newspapers, indicating the intention to sell or transfer ownership or control. This notice should be made at least 30 days before the takeover.

4. Share Transfer Agreement:

After obtaining RBI approval and the expiry of the 31-day notice period, sign the share transfer agreement and complete the financial transactions.

5. NOC from Creditors:

The target company must obtain a No Objection Certificate (NOC) from its creditors before transferring its business.

6. Asset Transfer:

Following RBI approval and completion of the required procedures, transfer the assets, ensuring compliance with all legal and contractual obligations.

7. Valuation:

The entity’s valuation is a crucial step, often conducted using the Discounted Cash Flow (DCF) method. A certificate by a Chartered Accountant should confirm the valuation method.

6. Notice to Regional Office:

Submit an application to the Regional Office of the RBI, containing information about proposed directors and shareholders, sources of funds, declarations, and bank reports.

Non-Banking Financial Companies (NBFCs) are integral to India’s financial landscape, and their takeovers play a vital role in reshaping the sector. The RBI’s Non-Banking Financial Companies (Approval of Acquisition or Transfer of Control) Directions, 2014, establish the framework for these transactions, ensuring regulatory compliance and transparency.

Ensuring Responsible Digital Lending: Key Guidelines and Default Loss Guarantee Arrangements

October 25, 2023

In today’s rapidly evolving digital landscape, digital lending has gained significant traction, providing borrowers with convenient access to financial services. To ensure customer protection, transparency, and responsible conduct, regulatory authorities have introduced comprehensive guidelines for digital lending operations. Additionally, the implementation of Default Loss Guarantee (DLG) arrangements offers an added layer of security for regulated entities engaging in digital lending. This article provides an overview of these guidelines and DLG arrangements, emphasizing their importance in fostering a trustworthy digital lending ecosystem.

Digital Lending Guidelines: Safeguarding Customer Protection and Conduct

Loan Disbursal, Servicing, and Repayment:

Regulated entities (REs) must ensure that loan servicing, repayment, and related transactions occur directly between the borrower and the RE’s bank account, eliminating the involvement of third-party intermediaries. Disbursements should be made directly into the borrower’s bank account, except for specific cases.

Collection of Fees and charges:

REs are responsible for ensuring that any fees or charges payable to Lending Service Providers (LSPs) are paid directly by the RE, preventing direct charges to the borrower. All applicable penal interest or charges should be clearly disclosed upfront in the Key Fact Statement (KFS).

Fair Interest Rates:

It is important to decide interest rates that are fair and reasonable, considering market conditions and the risk involved. Also, it is crucial to avoid usurious interest rates that could trap borrowers in a cycle of debt.

Disclosures to Borrowers:

Transparency is key in digital lending. REs should disclose the Annual Percentage Rate (APR) upfront and provide borrowers with a comprehensive Key Fact Statement (KFS) before loan execution. The KFS should include vital information such as the APR, recovery mechanism, grievance redressal officer’s details, and the cooling-off/look-up period. Any fees or charges not mentioned in the KFS cannot be levied on the borrower.

Both REs and LSPs should appoint a nodal grievance redressal officer to handle complaints related to digital lending. The contact details of these officers should be prominently displayed, and a robust complaint management system should be available for borrowers.

Assessing the Borrower’s Creditworthiness:

REs should capture the economic profile of borrowers before extending loans and ensure that credit limits are not automatically increased without explicit consent from the borrower.

Cooling off/Look-up Period:

To provide borrowers with flexibility, a cooling-off period should be offered, allowing them to exit the digital loan within a specified timeframe without incurring penalties. The cooling-off period, determined by the RE’s board, should not be less than three days for loans with a tenor of seven days or more.

Technology and Data Requirements

Data Collection, Usage, and Sharing:

REs must ensure that DLAs and LSPs collect borrower data based on explicit consent. Borrowers should have the option to provide or deny consent, restrict disclosure, revoke consent, and request data deletion or erasure.

Data Storage:

LSPs should only store minimal personal information necessary for operational purposes. REs should establish clear policies on data storage, privacy, and security.

Comprehensive Privacy Policy:

DLAs and LSPs should maintain a comprehensive privacy policy compliant with relevant laws and guidelines. Details regarding third parties authorized to collect personal information should be disclosed.

Technology Standards:

REs and LSPs must adhere to technology standards and cybersecurity requirements specified by regulatory authorities.

Financial Education:

Offer resources and information to help borrowers understand financial concepts, budgeting, and responsible borrowing. Promote financial literacy to prevent over-indebtedness.

Default Loss Guarantee (DLG) Arrangements

Scope and Eligibility:

DLG arrangements apply to regulated entities engaged in digital lending, including commercial banks, cooperative banks, and non-banking financial companies. DLG providers must be incorporated companies under the Companies Act, 2013.

Creditworthiness Assessment:

Data-driven methods must be employed to assess the creditworthiness of borrowers. It is vital to take into account their ability to repay loans. Experts highly suggest lending to individuals who are at high risk of default.

Structure and Forms of DLG:

DLG arrangements should be supported by explicit and legally enforceable contracts between the RE and DLG provider. DLG can be accepted in the form of cash, fixed deposits with lien, or bank guarantees.

Cap on DLG:

The total DLG cover on outstanding portfolios should not exceed five percent of the loan portfolio. For implicit guarantee arrangements, the DLG provider’s performance risk should not exceed five percent of the underlying loan portfolio.

Recognition of NPA and Regulatory Capital Treatment:

Responsibility for recognizing individual loan assets as Non-Performing Assets (NPA) and making provisions lies with the RE, irrespective of DLG cover. Existing norms for capital computation should be followed when considering DLG for regulatory capital.

Invocation, Tenor, and Disclosure:

DLG should be invoked within a specified overdue period, not exceeding 120 days. DLG agreements should remain in force for a period not less than the longest tenor of loans in the underlying portfolio. LSPs with DLG arrangements should disclose the number of portfolios and respective DLG amounts on their websites.

Due Diligence and Customer Protection:

REs should have a board-approved policy for DLG arrangements, including eligibility criteria for DLG providers and robust credit underwriting standards. DLG arrangements should not replace credit appraisal requirements. Customer protection measures and grievance redressal should align with existing guidelines on digital lending.

Regular Audits and Monitoring:

Adhering to regular internal and external audits to ensure compliance with regulations and ethical lending practices is really vital. Monitoring and assessment of the performance of loans and borrower behaviour must be a consistent practice.

Continuous Improvement:

Be open to feedback from borrowers and regulatory authorities to improve your lending practices. Continuously innovate and adapt to changes in the lending landscape.