Description

Business loans are a form of credit offered by lenders to businesses. In exchange for this money, lenders require repayment of the principal with interest and fees added to it.

- Long-Term Loans. For project financing. Expansion/modernization of facilities or acquisition of capital goods or services. Loan maturities range from 2 to 7 years.

- Short-Term Loans. To finance working capital requirements. Acquisition of raw materials, supplies, etc. Repayment within one year.

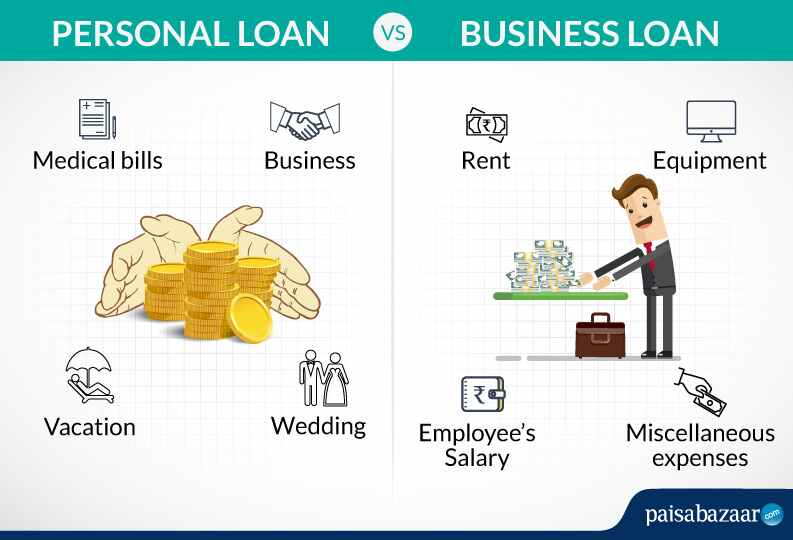

A business loan is borrowed capital that companies apply toward expenses that they are unable to pay for themselves. … Lenders want to know how the business intends to use the borrowed monies, so business owners must make sure to have a clear outline for how the money will be spent.

A small business loan gives you access to capital so you can invest it into your business. The funds can be used for many different purposes including working capital or improvements including renovations, technology and staffing, business acquisitions, real estate purchases and more.

Typically, business loans are paid back over a set amount of time, with regular repayments. While business loans work with this basic structure, they do vary by the type of business loan they are.

You pay interest only on the amount used. But the bank holds the right to repay your loan on short notice. It is a type of corporate loan where you receive money for your business assets like inventory or receivables. The amount allowed to withdraw is up to 70% of the value of the asset submitted.

Reviews

There are no reviews yet.