Description

Registration on the e-way bill portal is compulsory to generate e-Way Bills. Prerequisites for the registration on the e-Way Bill portal are the GSTIN of the registered taxpayer/transporter (if registered) and the registered Mobile number with the GST system.

e-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of Section 68 of the Goods and Services Tax Act read with Rule 138 of the rules framed thereunder.

Who should Generate an eWay Bill? Registered Person – Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person. A Registered person or the transporter may choose to generate and carry eway bill even if the value of goods is less than Rs 50,000.

- Step 1: Go to the e-way bill portal.

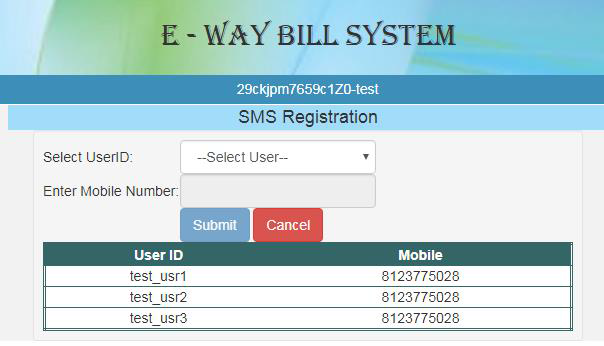

- Step 2: Go to the Registration tab and click on e-way bill registration.

- Step 3: Generate an OTP and submit the same.

- Step 4: Create the user ID and password.

Normally, E-way bill is generated by the Registered Person but, there is an option on E-way Bill system where even a person who does not have GST No. … Being the owner of the small shop and having a turnover of less than 20Lakh he does not have GST Number.

Reviews

There are no reviews yet.