Description

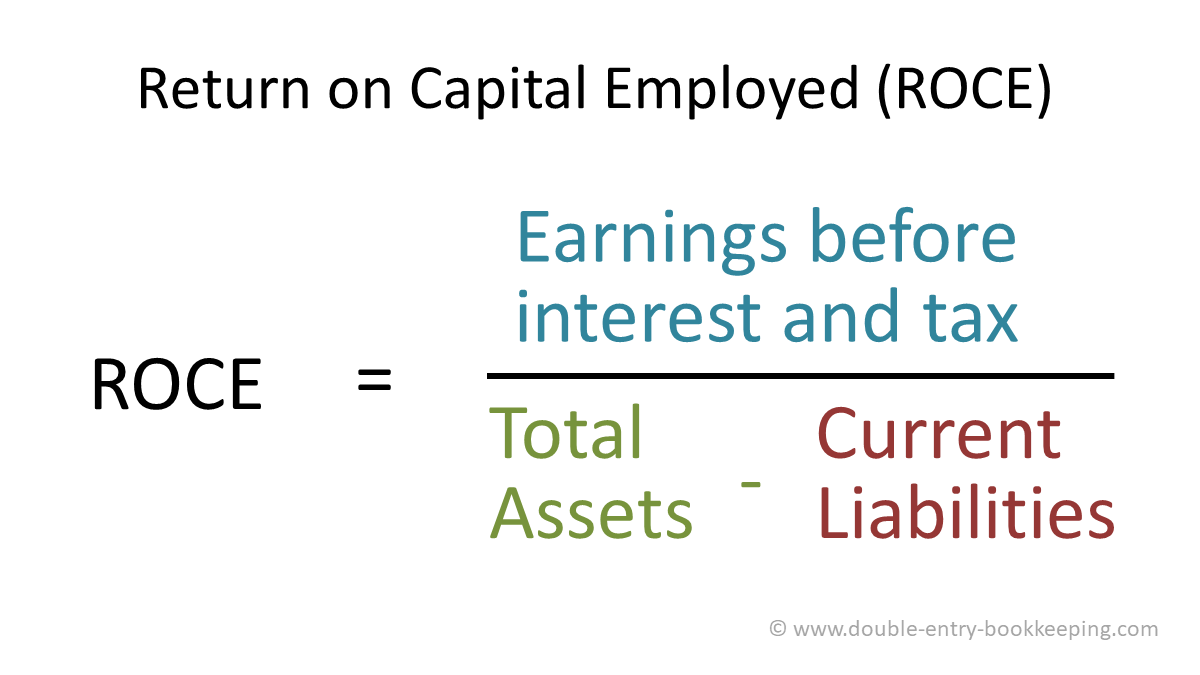

What is Return On Capital Employed or ROCE? Return On Capital Employed or ROCE is used to measure the profitability of a company. ROCE is a profitability ratio which measures the company’s profitability. This is done by measuring how the company is working and using its capitals to generate maximum profits.

ROCE is one of several profitability ratios used to evaluate a company’s performance. It is designed to show how efficiently a company makes use of its available capital by looking at the net profit generated in relation to every dollar of capital utilized by the company.

ROE considers profits generated on shareholders’ equity, but ROCE is the primary measure of how efficiently a company utilizes all available capital to generate additional profits. … This provides a better indication of financial performance for companies with significant debt.

There are no firm benchmarks, but as a very general rule of thumb, ROCE should be at least double the interest rates. A return any lower than this suggests a company is making poor use of its capital resources.

The most obvious place to start is by reducing costs or increasing sales. Monitoring areas that may be racking up excessive or inefficient costs is an important part of operational efficiency. Paying off debt, thereby reducing liabilities, can also improve the ROCE ratio.

Reviews

There are no reviews yet.